Table of Contents

- What is Internet banking?

- Uses and Benefits of Gtbank internet banking platform

- How secure is the Gtbank Internet Banking platform?

- Guaranty Trust Bank (GTB) internet banking Registration Procedure and requirements

- How to retrieve your Gtbank internet banking password when you forget

- How to change your Gtbank internet banking password

- Changing your secret question and answer

- How to retrieve forgotten secret question and answer

- Gtbank internet banking, Mobile app and Mobile money; which is better?

What is Internet banking?

It is a form of banking where by you make use of the internet to control your bank account without actually going to the bank. Internet banking is very important for so many reasons and also has its limitations and disadvantages. However, the benefits of internet banking outweigh the disadvantages. You will learn about how Gtbank operates its internet banking services.

If you buy things online from Konga or Jumia or Amazon, Gtbank Internet Banking will make life much easier for you. If you run an online business, Gtbank Internet Banking will be of help to you with functionalities that you can use for efficient running of online business. I am not promoting the bank for any gains but I am writing out of experience because I am using the Gtbank Internet Banking and it is better than other banks. No doubt, Gtbank is more advanced than other banks in Nigeria and across the world. They are the pioneers of Information Technology in Nigeria as other banks learn from them.

Gtbank first started the use of Mobile phones for banking through various services such as: use of mobile phones to check account balance; use of mobile phones for transfer of money to another Gtbank account and to another bank and also their Mobile banking App. Other banks can only allow you to use your phone to transfer money to another account within the same bank but do not have the capability to transfer money to another bank yet. I will go into details about this and you will find out why Gtbank is the best for running business online.

With the current economic challenges in Nigeria, most banks have stopped the use of the Naira MasterCard for online payments, which means you cannot buy anything online that require payments in dollars or other currencies; but Gtbank still allows you to be able to spend up to 100 dollars in a month (at least it can help you to pay for important things such as web hosting when you are creating and managing websites for business; imagine if you pay for hosting a website monthly and all of a sudden your bank disables your Naira MasterCard, it means your website will no more exist except if you are using a domiciliary account of which few Nigerians have). For those that cannot use their Naira master card for online payments, it is best to open a domiciliary account and get a Dollar master card and use it for payments because if you are really serious with online business, you should have a domiciliary account and I will recommend GTbank Domiciliary account because you do not need money (dollar or naira) to open the Dom account unlike other banks that require you pay initial deposit of about 50 dollars or more into the account to be active.

Uses and Benefits of Gtbank internet banking platform

- Use for transfer of Money from one bank to another bank or transfer of money online from one Gtbank account to another Gtbank account any day of week including weekends (Saturdays and Sundays) and the users get credited instantly

- To exchange dollars to naira

- To deactivate your token when lost or when stolen

- To open a domiciliary account without going to the bank

- To check your account balance anytime

- To pay bills and airline tickets

- To pay for school fees

- To pay any government agency through the Remita payment platform

- To apply for bank loans such as Salary in advance and other investment loans

- You can request for alert notifications to be sent to your phone for any transaction

- To apply for dollar master card for online payments without restrictions of funds transfer

- You can get your statement of account without going to the bank. The statement of account can be in the form of PDF or Excel file and you can easily save it to your computer.

- You can link you Bank Verification Number (BVN) to any bank account by yourself

- You can get your BVN

- You can make standing orders to GTbank accounts or other banks

- You can get details about your ATM card such as ATM card number, the Card CVV2 and expiry date if the numbers printed on your ATM card are faded

- You can ask for ATM card replacement anytime it gets lost or gets stolen without going to the bank

- You can block funds transfer especially if your ATM card gets stolen and someone is withdrawing your money on weekends when banks are closed.

- You can change the Pick-Up location for your card replacement if you relocate or travelled to another place. Assuming you applied for ATM card replacement in Abuja and you later travelled to Jos. You can use the Gtbank Internet banking platform to change the pick-up location to Jos.

- You can recharge your phone or your friends or love ones phones

- You can buy data bundles directly for any network without going out of your room

- Gtbank Internet Banking helps you to buy stocks and investments online

- You can receive money and track the money via Western Union

- You can transfer dollar to another dollar account within GTBank or to another dollar account in another bank

- You can convert your dollars to naira and your Naira account is credited immediately

- You can book for all local and international flights on the Gtbank Internet Banking

- You can chat with GTBank Customer care agents directly online and get your issues resolved

- You can refer people to open account with GTbank and make money on Gtbank Internet Banking

How secure is the Gtbank Internet Banking platform?

Security is a two way process. You need to secure your account as well as your bank making efforts to secure your account.

Before logging in, there is a notice that enlightens novice users to secure their accounts to prevent access to their accounts. This notice is titled SCAM ALERT. And the actions needed to be taken are listed below.

How to secure your Gtbank Internet Banking account

- Never allow anyone whether your friends or relatives to stay around when logging in to the Gtbank Internet Banking portal because they can view your account details and may gain access to your account. Sometimes friends may turn to enemies and may use it against you without you knowing or they may even tell someone who might use it to gain access to your account

- Do not disclose your pin or password or user id to anyone. Do not use Passwords that can easily be guessed such as your birthday, you year of birth, your girlfriend, wife or childs birth day or birth year. Do not use the digits of your phone number or your age or a combination of your age and that of your love ones. These types of passwords can easily be guessed. Use something that is unrelated to you that you can remember easily. To further secure your Gtbank Internet Banking account, you should not use the same password as that of other websites or social media because once the passwords of those websites are known, it can be used on your bank account.

- If you think your password or Pin has been known by someone, please change it immediately on Gtbank Internet Banking platform

- The correct URL or Link to the GTBANK website is www.gtbank.com. You must never login to any other website no matter how similar it looks like that of Gtbank. Always check the Url of the website in your browser. Please note that websites like: gtb.com, gtbannk.com, gtbnk.com, gtbabnk.com.ng, gtb.com, gtb.com.ng and gtbank.ng are NEVER the same as gtbank.com, no matter how similar the names are, they are never the same. The real link to the website is gtbank.com. There could be prefix to the gtbank.com such as ibank.gtbank.com. This is correct because it is still gtbank.com

- Guaranty trust bank or any other bank will NEVER ask you of your ATM card or passwords or pin or user id or any sensitive information; even if it is the CEO of GTBank, never give any information. Some Fraudsters scam users by sending text messages that your ATM card has been banned or blocked due to incomplete BVN registration and they will give a number for you to call. Never call and never send any information.

- Do not use a public computer to login into the Gtbank Internet Banking platform as anyone could use the computer and you may never know the software installed on it including the spywares/malwares.

- Do not use someone elses computer or phone whether you know the person or not as you will make your account vulnerable the same as a public computer does.

Efforts by GTbank in securing your Gtbank Internet Banking

Gtbank also tries hard to protect your account in ways you may not know. These include:

- Gtbank login details are transferred via a secure network; that is why when you need to login, the website Url changes to https:

- Gtbank enlightens users via different platforms such as the Gtbank Internet Banking platform as explained above; in the banks, you will often see TVs with campaigns and animations that tutor you on how to secure your account; emails are sent by GTBank on how to secure your accounts

- The login page of the Internet Banking portal does not allow for entry of password by typing on your keyboard but rather use of buttons displayed on the screen that requires you to use the mouse to press the buttons. This is an important security measure because there are spywares (usually called Keyloggers)that are unknowingly installed by users on their devices and computers that collects all the keys that a user presses including the websites the user is visiting and transmits the information to the hackers which will show them your password and pin and other details. Most times users do not know whether they have installed these malwares/spywares because they are often installed together with other software; hence the need of Gtbank to avoid this and making the users to use the mouse to press buttons. The position of the numbers on the login page keep changing again anytime you refresh the page to make it more difficult for hackers and more secure.

- Incorrect login up to three times will permanently lock your account until you go to the customer care service at the bank or you call GTCONNECT to unlock it.

- After logging, if you stay for some minutes without any activity, Gtbank automatically logs you out in order to make it difficult for hackers not to have enough time to think on what to do. In internet and online security, the less time and chances you give to hackers, the better the security and the harder it becomes for them.

- Anytime you login to the Gtbank internet banking portal, GTbank automatically sends you an email to notify you that someone logged into your Internet Banking account.

- Anytime a new beneficiary is created, a text message is sent to you to alert you that a transaction is initiated.

- You need to answer a secret question correctly before a transaction is completed. The secret question is asked during registration of Gtbank Internet Banking, during sending of funds, during changing of password and many more.

- Anytime you initiate a transaction, you will require additional confirmation code. This confirmation code can be generated by a small device called a Token Device or Gtbank sends the code through your phone. If you do not have this code, even when you are in someones account, you cannot complete a transaction. This is the reason why fraudsters will tell you that they will send you a code, of which you need to tell them in order to unblock your ATM card. This so-called Code they say they will send to you is actually because they have initiated a transaction in your Gtbank internet banking account (they may get access into your account if you bridge any of the mentioned security guidelines above) and they need to complete the transaction. Since your bank will send the code to your phone, they act as if they (the hackers) are the ones sending the code. Once you read out the code to them, they will complete the transaction by entering the code in the space provided and your money will be deducted. This is the reason why you should NEVER send any code to anyone.

With these security measures, online banking becomes secure and much more stress free as you need not go to the bank to do all of these functionalities.

Guaranty Trust Bank (GTB) internet banking Registration Procedure and requirements

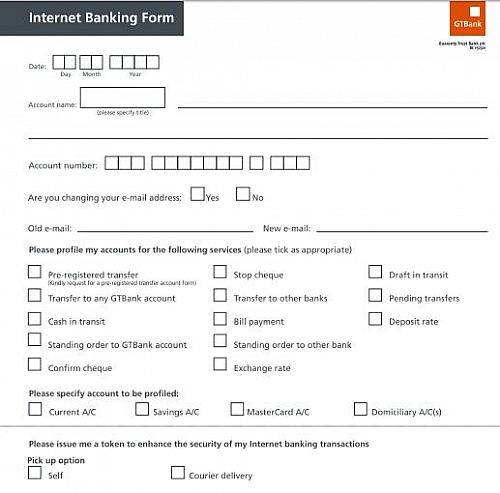

- Download the GTBank internet banking form. It is a PDF file that you need to print and fill the information

- Scan the filled internet banking form you downloaded and sent the image via an email to internetbanking@gtbank.com it is better to just take the form to any GTBank branch than sending it through the email.

- Wait for about 2 working days, your user ID and Password will be sent to you by email.

- Or instead of downloading the Gtbank internet banking form, just go to any Guaranty trust bank branch and request for Gtbank internet banking to be created for you. The form will be given to you. Fill it there and give it back to them.

- When you get the email, change your password. The password is actually a minimum of 4 digits number and not actually a word or alphabets.

- If you did not get the email after 2 working days, go to the customer care of the bank you did the registration at and complain.

- You do not need any prove of identity or document to create an account on the Gtbank internet banking platform.

Details to fill in the Gtbank internet banking registration form

- Your bank account name and account number

- Your email address. This will be used to send the user id and password

- Check boxes for selecting the services you want, to be added to your Gtbank internet banking account. You can later add other services.

- You will specify on the form by selecting which of your bank accounts (if you have more than one) you want to add to the GTBank internet banking. You can select all account types if you have more than one.

- Specify if you need a Token device for generation of codes in order to complete any transaction. You will be charged about 2000 naira or more. I did mine 3 years ago when the charges were less. The token device can be used for 5 or more years. If you do not select the Token to be issued to you, you have to pay 10 naira for every transaction you need to complete whenever a text message is send to you with the code.

- Sign the form and submit and wait for about 2 working days for your account to be created.

How to retrieve your Gtbank internet banking password when you forget

- Go to www.gtbank.com website and click on Login

- Just below the buttons for entering the password, there is an option for Forgot your Password?

- Click on it and fill the form displayed by answering your secret question.

- Click Continue , the Password will be sent to your email that you used while creating your account

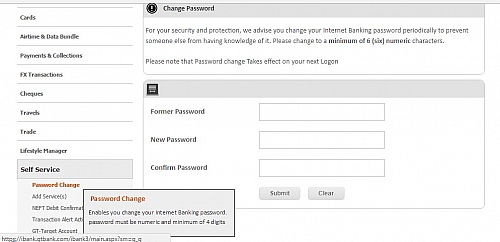

How to change your Gtbank internet banking password

- Log into your Gtbank internet banking account

- Click the Self Service menu

- Click the Password Change

- Fill the form by inputting former password, the new password, confirm new password and submit

- Your new password will be updated

Changing your secret question and answer

- Log into your Gtbank internet banking account

- Click the Self Service menu

- Click the Reset Secret question and Answer

- Fill the form by inputting the new question, the new answer, confirm new answer, mothers maiden name, click your Token device to generate the code(enter the code) and submit

- Your new question will be changed

How to retrieve forgotten secret question and answer

- Go the Gtbank.com website and click on Login

- Just below the buttons for entering the password, there is an option for Forgot your secret question?

- Click on it and the secret question would be sent to the email address you used to create the Gtbank internet banking account.

- Check the mail, the secret question would be there

Gtbank internet banking, Mobile app and Mobile money; which is better?

Whatever functionality that the Gtbank Mobile app offers, the internet banking offers much more and Mobile money to me seems outdated and more complex and more limited. Internet banking is better than mobile app and mobile money.

Gtbank internet banking helps you transfer money to any bank account and also helps relieve the stress of going to the banks and queuing up for services that could have been done in the comfort of your room.