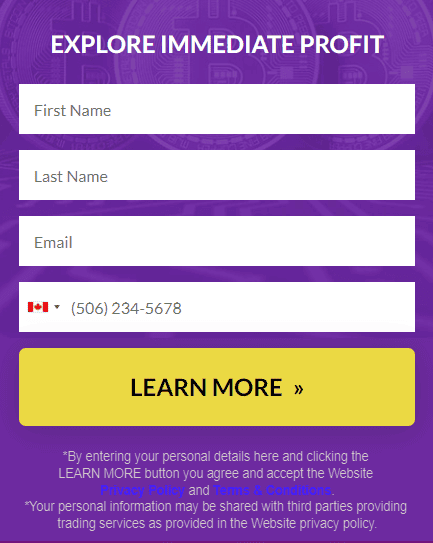

Discover the intricate relationship between Wrapped Bitcoin (WBTC) and cryptocurrency regulations. In this article, we delve into the understanding of crypto regulations for WBTC and the impact of regulations on WBTC and the market. If you’re interested in Bitcoin trading but lack experience, worry not! You can click on the below image link and learn how you can execute profitable trades with ease.

Table of Contents

Understanding Cryptocurrency Regulations for Wrapped Bitcoin

Cryptocurrency regulations play a crucial role in shaping the operations and use of digital assets such as Wrapped Bitcoin (WBTC). To fully comprehend the regulatory landscape surrounding WBTC, it is essential to examine the current status and various governmental approaches to regulating this form of tokenized Bitcoin.

The regulatory landscape for WBTC is still evolving as authorities worldwide grapple with how to effectively oversee and govern digital assets. Different countries have taken diverse approaches to cryptocurrency regulations, with some embracing the technology while others have been more cautious or restrictive.

When it comes to WBTC, governments are primarily concerned with issues such as financial stability, consumer protection, anti-money laundering (AML), and counter-terrorism financing (CTF) measures. These concerns have led to the implementation of compliance and reporting requirements for WBTC users to ensure transparency and accountability within the ecosystem.

For users of WBTC, understanding and complying with regulatory requirements is crucial. It is essential to stay informed about the latest guidelines and obligations to avoid any legal or compliance issues. By adhering to these regulations, users can contribute to a safer and more transparent environment for WBTC transactions.

Compliance measures may include Know Your Customer (KYC) procedures, which involve verifying the identity of users, as well as implementing AML and CTF protocols. These requirements aim to prevent illicit activities such as money laundering, terrorist financing, and fraud within the WBTC ecosystem.

Moreover, governments may enforce licensing and registration processes for platforms and exchanges dealing with WBTC. These measures help establish a regulatory framework and allow authorities to monitor and supervise the operations of WBTC-related entities.

While regulations may impose certain limitations on WBTC transactions and use, they also bring potential benefits. Regulatory oversight can enhance investor confidence by providing a more secure and trustworthy environment for WBTC participants. It may also foster mainstream adoption by addressing concerns related to illicit activities and market manipulation.

Impact of Regulations on Wrapped Bitcoin and the Crypto Market

One of the key impacts of regulations on WBTC is its liquidity. Regulatory requirements, such as KYC procedures and licensing processes, may increase the compliance burden on WBTC platforms and exchanges. This could result in a reduction in liquidity as some users may be deterred by the additional requirements and choose to exit the market. Reduced liquidity can have a negative impact on WBTC trading volumes and the overall efficiency of the market.

Regulations also play a role in shaping the adoption of WBTC. Depending on the jurisdiction and the specific regulatory framework in place, some potential users or investors may be hesitant to engage with WBTC due to concerns about compliance or legal risks. Clear and well-defined regulations can provide clarity and reassurance, potentially driving wider adoption of WBTC as users feel more confident in participating in the ecosystem.

Market volatility is another aspect influenced by regulations. The introduction of regulations can lead to short-term price fluctuations as market participants react and adjust their strategies to comply with new requirements. Additionally, regulatory announcements or changes in stance by authorities can create uncertainty and impact market sentiment, resulting in increased volatility. However, in the long run, regulations can help stabilize the market by reducing fraudulent activities and enhancing investor protection.

Investor confidence is vital for the growth and sustainability of WBTC and the wider crypto market. Clear and transparent regulations can help build trust and confidence among investors, attracting institutional players who may have been hesitant to enter the market due to regulatory uncertainties. Increased investor confidence can contribute to the maturation of the market, potentially leading to greater liquidity, improved market infrastructure, and a broader range of investment opportunities.

It is important to note that the impact of regulations on WBTC and the crypto market is a delicate balance. While regulations can provide benefits such as increased investor protection and market stability, excessive or overly restrictive regulations can hinder innovation and growth.

Conclusion

Regulatory measures can affect liquidity, adoption, market volatility, and investor confidence. Striking the right balance between oversight and fostering innovation is key for the future of WBTC and the broader crypto market. By staying informed and complying with regulations, users can contribute to a safer and more sustainable environment for WBTC transactions.