Table of Contents

What is an oligopoly?

The word oligopoly originated from two Greek words, oligi which means few, and polein which means to sell. It, therefore, refers to a market structure whereby there are few firms that produce and sell homogeneous or differentiated products. Under this market structure, the or sellers are few but more than two. None of these firms can keep others from having a significant influence. In this case, the concentration ratio takes a measurement of the market share of the largest firms. This market structure lies between monopoly and monopolistic competition.

We can, sometimes refer to oligopoly as a competition among the few because there are few sellers in the market or industry and each has a significant influence on the behavior of other firms and also, the behavior of other firms as well, influences each firm in the industry. In other words, the market structure implies a small number of producers that work either explicitly or tacitly to restrict output and fix prices with the aim of achieving above normal market returns.

There are several factors that contribute to the formation and maintenance, or dissolution of oligopolies such as economic, legal, and technological factors. The prisoner’s dilemma is a major difficulty that the oligopolistic firms face. This encourages each member firm to cheat. Government policies can either encourage or discourage oligopolistic behaviors. Firms that operate in mixed economies usually seek the blessing of governments for ways to limit competition. Firms under oligopoly can either produce products that are homogeneous or products that are differentiated.

The prisoner’s dilemma

This is a situation whereby individual decision-makers always have an incentive to make their choice in such a way that creates less than optimal outcomes for the individual as a group.

The major challenge that the oligopolists face is that each of them has an incentive to cheat. In this case, if all oligopolistic firms engage in a joint agreement to restrict supply and keep their prices high, then each of them stands to capture substantial business from others by breaching the agreement thereby selling below other competitors. Firms can wage such competition through prices or by an individual company expanding its own output which it brings to the market.

Game theorists have developed models for these happenings thereby forming a sort of prisoner’s dilemma. When there is a balance between costs and benefits for firms not to want to break from the group, then we consider it as the Nash equilibrium state for oligopolies. This is achievable by contractual or market conditions, legal restrictions, or the existence of strategic relationships between oligopolistic firms to facilitate the punishment of cheaters.

Oligopolistic firms can however benefit from the collective setting of prices, price-fixing, or under the direction of a single firm in the group instead of being dependent upon the free-market forces to be the determinant.

The oligopoly market structure

In the oligopoly market structure, few producers or firms dominate the market or industry. This market can be local, national, or international. In the market, firms have pricing power. Unlike a monopoly where a single firm dominates the market, an oligopolistic firm must be considerate about how other producers will react to any changes in price. The mutual interdependence that exists among the few firms that produce the products is a major factor that makes an oligopoly distinct from a monopoly. Strategic decisions determine price and output on the basis of the response of other member firms to changes in price or output by one member/firm. In some cases, oligopolists will try to increase their market power by forming a cartel which is a group of firms that act in unison.

Oligopolistic firms are generally large and need to invest a huge amount of capital in order to produce a product such as an aircraft, motor vehicles, etc. This huge initial capital investment is a major barrier to entry to oligopolistic markets. Other barriers include the control of strategic resources, patents, and the ability to engage in retaliatory pricing in order to prevent new firms from entering the market.

Oligopolistic firms are the ones that set prices either in a cartel, collectively, or under one firm’s leadership rather than taking prices from the market. With this, their profit margins become higher than they would have been in a more competitive market.

In history, oligopolies include oil companies, steel manufacturers, grocery store chains, railroads construction companies, tire manufacturers, and wireless carriers. The prevailing economic and legal concern is that oligopolistic firms can place barriers to the entry of new firms. Also, slow innovation and an increase in prices of commodities are areas of concern as they can harm consumers.

Types of oligopoly

The following are the different types of oligopolies;

- Pure or perfect oligopoly

- Differentiated or imperfect oligopoly

- Collusive oligopoly

- Non-collusive oligopoly

Pure or perfect oligopoly

The presence of few, large firms that produce homogeneous products implies pure or perfect oligopoly. Though this is rare to find, we can, however, find this in cement, aluminum, steel, and chemical producing industries. They constitute pure oligopoly.

Differentiated or imperfect oligopoly

When few, large firms produce differentiated products (products that are not identical), we refer to this situation as a differentiated or imperfect oligopoly. Examples include passenger vehicles, soft drinks, and cigarettes. Here, different firms possess their own distinguishing characteristics but all of them can be close substitutes for one another.

Collusive oligopoly

This is a situation whereby firms cooperate with one another while determining price, output, or both. We call this collusive or cooperative oligopoly.

Non-collusive oligopoly

When oligopolistic firms compete with one another, we call this a non-collusive or non-cooperative oligopoly.

Oligopoly examples

It is presently possible to find oligopolies in different industries. We can find them in the entertainment, airlines, social media, automobile industries, etc.

Entertainment industry

Hollywood, universal, Disney world, sony, etc seem to be the biggest movie studio, assessing them based on their market share. They are oligopolistic in nature.

Airline industry

In the United States, we can refer to the airline industry as an oligopoly because there are four leading domestic airlines that dominate the market. These airlines are American Airlines, Southwest Airlines, Delta Airlines, and United Airlines.

Search engines

Search engines are what people use daily for their personal needs. In the world, there are ten search engines that are most popular but only a few of them dominate the market. Google and Bing are the two major search engines, yet Google is the leading among others as well as the most popular. The market share of Google as of February 2021 is 86.6 percent while Bing had 6.7 percent.

Social media

Billions of people use social media worldwide such that it is almost impossible to live without. Social media worldwide include Facebook, WhatsApp, Instagram, and Twitter. Facebook is the world’s largest social media as it has over 2.45 billion active users monthly.

Big technology

The big technology industry encompasses operating systems for phones, laptops, and personal computers. Customers usually choose between Apple iOS and Android among smartphones. For laptops, customer choices usually revolve between Apple and Microsoft Windows as they are the most popular and influential.

Automobile manufacturers

In the United States, the largest automobile industries include Ford Motor, Stellantis North America, and General Motors. Because they are the largest automobile manufacturers, they represent an oligopoly.

Oil-producing states

OPEC is a typical example since it is a cartel of oil-producing nations with the absence of overarching authority. Oligopolies can alternatively seek out and lobby for a government policy that is favorable to them in mixed economies, to operate under the government agencies, regulation as well as direct supervision.

Oligopoly characteristics

- The presence of few firms

- Interdependence

- Non-price competition

- Barriers to the entry of new firms

- Role of selling costs

- Group behavior

- Nature of the product

- Indeterminate demand curve

- Rigid prices

- Mergers

- Collusion

The presence of few firms

It is a small number of large firms that dominate the industry. Each of these firms is relatively comparable to the overall size of the market thereby generating substantial market control. The extent of this market control is dependent upon the number and size of the firms. Although there is no definite number for the large firms, each firm has a definite portion of the overall output that it produces. Sometimes, there is severe competition among different firms and each of these firms tries to manipulate both prices and the volume of production to outsmart one another. Because of the small number of firms, the action of one firm is likely to affect the actions of rival firms. This causes every firm to keep a close watch on the activities of rival firms.

Interdependence

Under the oligopoly market structure, firms are interdependent. The word interdependence means that the action of one firm affects the actions of other rival firms. A single firm considers the actions or reactions of other firms (rivals) in the industry while determining the price and levels of output. A change in the price or output by a firm will certainly trigger reactions from other firms that are operating in the market. It is easy to compare the actions of oligopolistic firms to a game or an athletic contest. This is a situation whereby the actions of one team do not only depend on its actions but also on the actions of its competitor.

An oligopolist does not have total control over the supply side as it is in the case of a monopolist, but its capital is significantly greater than that of the firms in monopolistic competition. There is a high tendency for oligopolistic firms to turn into cooperating oligopolistic firms.

Non-price competition

Oligopolistic firms are usually in a position to influence prices although they try to avoid price competition for the fear of price war. In this case, they go by the policy of price rigidity. Price rigidity refers to a situation whereby price tends to remain fixed regardless of the changes in the conditions of supply and demand. Firms will rather use other mediums such as advertising, better customer services, product differentiation, etc., to compete with one another.

In this case, rival firms will react by reducing prices if a firm reduces the price. Also, if a firm tries to raise prices, other rival firms might react by doing the same. This will amount to a loss of customers for a firm that intends to raise its price. Because of this, firms prefer non-price competition instead. Oligopolistic firms aim at attracting buyers and increasing their market share while they hold the line on price.

Barriers to entry of firms

The barriers to the entry of new or potential firms into the industry are the reason why there are only a few firms in the industry. Through this, such industries attain and retain market control. Patents, large capital requirements, ownership, and control of resources, etc., constitute the barriers to the entry of new firms. In other words, these factors make it extremely difficult for potential or new firms to enter the industry. This in turn makes oligopolistic firms generate abnormal profit in the long run.

Role of selling costs

As a result of the fierce competition and interdependence that exist amongst firms, there are various sales promotion techniques that they use to promote sales of their product. Under the oligopoly market structure, advertisement is in full swing. Oftentimes, the advertisement can become a matter of life and death for a firm. Oligopolistic firms rely more on non-price competition. Therefore, selling price is more important under oligopoly than it is under monopolistic competition.

Group behavior

A complete interdependence among firms exists in the oligopolistic industry. So, the price and output decisions of a particular firm directly influence the competing firms. Instead of an independent price and output strategy, oligopoly firms prefer group decisions that will protect the interest of all the firms. What group behavior means is that firms tend to behave like a single firm even though they retain their individual independence.

Nature of the product

While some oligopolistic firms produce identical products, others produce differentiated products. Oligopolies with identical products tend to process raw materials or intermediate goods that other industries use as inputs. On the other hand, differentiated oligopolies tend to focus more on consumer goods that aim at satisfying a wide range of consumer wants and needs. In essence, oligopolistic firms produce either homogeneous/identical or differentiated products.

Indeterminate demand curve

Under the oligopoly market structure, we cannot determine the exact pattern of behavior of a producer with certainty. This implies that the demand curve that oligopolists face is indeterminate, which is uncertain. As a result of the fact that firms are interdependent, it is impossible for a firm to ignore the reaction of rival firms. This means that, if a firm changes its price, other competing firms will also change their prices. This causes the demand curve to keep shifting and it is not definite. In other words, it is indeterminate.

Rigid prices

A lot of oligopolist industries, though not all, oftentimes keep their prices relatively constant. By implication, they prefer to compete in ways that have nothing to do with the change of price. The primary reason for rigid prices is that there is a likelihood for competitors to match decreases in price, but not increases. This makes oligopolistic firms have just a little to gain from changing prices.

Mergers

It is a perpetual thing for oligopolistic firms to balance competition against cooperation. A major way to pursue cooperation is through a merger, which is a legal combination of two separate firms to form a single firm. The fact that there is a small number of firms in oligopolistic industries has heightened the incentive to merge. When they do this, they gain greater market control.

Collusion

Another common method of cooperation of oligopolistic firms is collusion. This is a situation whereby two or more firms secretly agree to control prices, production, or other aspects of the market. Doing this the right way means that the firms behave as if they are a single firm, a monopoly. They have the ability to set monopoly prices, produce a monopoly quantity, and allocate monopoly as inefficiently as it is in the monopoly market structure. A formal method of collusion usually common among international brings forth a cartel.

Oligopoly graph

Different diagrams explain the oligopoly markets. It is therefore important to note that oligopolies can behave in different possible ways. We shall look at the following;

- Kinked-demand curve

- Oligopoly economies of scale

- Collusive oligopoly

Kinked-demand curve

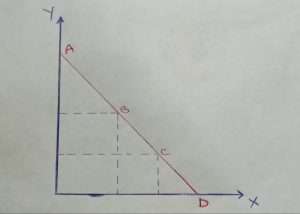

We illustrate the short-run production activity of an oligopolistic firm using a kinked-demand curve. This demand curve possesses two different segments with different elasticities of demand that come together to form a kink. The primary aim of the kinked-demand curve is to explain the rigidity of price in an oligopoly. The two segments in the demand curve are;

- Elastic segment as price increases

- Inelastic segment as price decreases

These two segments are based on the fact that the decisions of oligopolistic firms are interdependent.

Because of the fact that competing firms are unlikely to match the increases in the price of an oligopoly, there is a tendency for the firm to lose its customers and market share to the competition. A slight increase in price can result in a relatively large decrease in the quantity demanded. On the other hand, because competing firms are likely to match the decreases in price, they are unlikely to gain customers as well as market share from the competition. These firms need a large decrease in price to gain relatively small increases in the quantity demanded. Each segment of the demand curve has its own marginal revenue segment.

In essence, an oligopolistic firm faces a kinked demand curve model. Here, the demand curve will maximize profits at Q1 P1 where the marginal revenue is equal to the marginal cost (MR=MC). Thus, a change in marginal cost may not bring about a change in the market price.

There are certain assumptions with regard to the kinked demand curve, thus;

- The firms are profit maximizers.

- If a single firm increases the price, other firms will proportionately respond by increasing theirs as well. For the price to increase, the demand is, therefore, price elastic.

- Other firms will follow suit by cutting down their prices if one firm cuts down the price. They act this way because they do not want to lose their market share. Therefore, the demand is price inelastic for a decrease in price.

However, there are limitations to the kinked demand curve, thus;

- It fails to explain how firms arrive at the price in the first place.

- Firms are bound to engage in price competition.

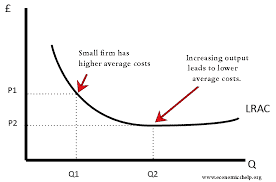

Oligopoly economies of scale

Oligopolies are able to achieve economies of scale where they reduce their cost of production and price while they increase their returns. Because they are few but large firms in the industry, they mass produce their commodities at a low average cost. Most modern commodities such as cars, aircraft, computers, and household products if a large number of small firms produce them, rather than a small number of small firms. Because of this, oligopolistic firms take advantage of economies of scale thereby achieving great returns from their output.

In other words, the product of an oligopolistic firm exhibits large economies of scale where the cost of producing each unit, that is average cost (AC) declines as the output increases. These economies of scale place barriers on the entry of other firms into the market, as there would be little market share that they could gain and would be insufficient for them to be profitable. Oligopolistic firms producing at Q1 achieve lower prices of AC1.

Collusive oligopoly

In an oligopoly, firms collude to form a cartel, they will then try to fix their price at the level in which they maximize profit for the industry. They will therefore put quotas in place to maintain output at the level in which they maximize profit (the profit-maximizing level). In this case, the price and output in an oligopoly will reflect the same as a monopoly. Here, the quantity Qm will be split between firms in the cartel.

Advantages of oligopoly

High profits

Due to little competition, oligopolistic firms in the market have the potential of yielding large amounts of profits. Usually, there is a high demand and need for those goods that oligopolistic firms control. Firms can channel extra profits towards research and development. An economy that experiences oligopoly in some way can manufacture a dynamic set of products and processes through a desire to be innovative.

Simple choices

When there are few firms in the industry that provide goods and services, it becomes easier for consumers to compare among different firms and make the best choice for themselves. In other markets, it is usually difficult to critically assess all the competitors that are available and then compare products or services and their pricing.

Competitive prices

It is easier to compare prices in an oligopoly. This forces the firms to keep their prices in competition with other companies that exist in the industry or market. This is greatly beneficial to the consumers because as prices continue to go lower, their purchasing power increases.

Better information and goods

Oligopolies provide more information to their consumers usually through advertising. It becomes easier because of the small number of firms that exist in the industry.

Price stability

Although prices in the oligopoly market are usually higher than they should be in the regular competition levels, an economy can experience a significant level of price stability. This greatly helps consumers to plan ahead with a fair amount of certainty towards their needed expenses thereby providing for fewer debts to be managed.

More product refinement

In the oligopolistic industry, it is easier to facilitate product refinement. In essence, the availability of more funds to channel towards research and development processes, will not only go to the creation of new products. This inventment can help in refining the current inventory and increasing the overall value proposition that consumers will experience in each situation.

Disadvantages of oligopoly

Fewer choices

Although fewer choices can save time, this is not always a good thing. If no product meets the needs of a consumer, then other options will be unavailable. The consumer will be forced to go with the product that meets their needs partially while incurring full costs or forfeit the product.

Inefficiency

The market tends to be at the same point as they become as inefficient as the monopoly market while allocating resources.

Price fixing

Price fixing is common and this turns out to be bad for consumers because it forces consumers to pay high prices for commodities.

No fear of competition

Usually, oligopolistic firms tend to be comfortable with their current position since there is a guarantee for their businesses to work. They no longer see the need to come up with creative and innovative ideas.

Frequently asked questions

What is an oligopoly with example?

Oligopoly refers to a market structure whereby there are few firms that produce and sell homogeneous or differentiated products. These few firms are usually large and they dominate the market. An example of oligopoly is the search engine. In the world, there are ten search engines that are most popular but only a few of them dominate the market. Google and Bing are the two major search engines, yet Google is the leading among others as well as the most popular. The market share of Google as of February 2021 is 86.6 percent while Bing had 6.7 percent.

What is an oligopoly in economics?

Oligopoly in economics refers to a market structure where few large firms sell either homogeneous or differentiated products.

What are the 4 characteristics of oligopoly?

The following are the characteristics of oligopoly;

- The presence of few firms

- Interdependence

- Non-price competition

- Barriers to the entry of new firms

- Role of selling costs

- Group behavior

- Nature of the product

- Indeterminate demand curve

What are five examples of oligopolies?

The airline industry in the United States which are American Airlines, Southwest Airlines, Delta Airlines, and United Airlines.

Social media is an oligopolistic market such as Facebook, WhatsApp, Instagram, and Twitter. Facebook remains the largest social media in the world.

Big technology encompasses operating systems for phones, laptops, and personal computers.

The automobile industry also constitutes an oligopoly. The dominant firms in the United States under this industry include Ford Motor, Stellantis North America, and General Motors

OPEC is a typical example since it is a cartel of oil-producing nations with the absence of overarching authority.