Table of Contents

What is Debt Consolidation?

Debt consolidation is the process of combining several debts with different companies into a single debt that can be easier to repay. There are different ways of consolidating existing debts into a single debt; each method has pros and cons, all of which we will discuss below.

The main advantage of consolidating multiple high-interest debts into one is that it lowers the interest rates when done properly; since you now have one monthly payment, the risk of default is reduced and it becomes easier to pay than having to deal with multiple monthly payments, interest rates, and payment schedules which may increase the likelihood of default. Debt consolidation can help with your credit score when you make timely debt payments.

Debt consolidation is definitely a good idea for many people. It can be an amazing way to streamline your finances, reduce the stress of having multiple bills due every month and give you the opportunity to take advantage of lower interest rates on loans or credit card balances. However, if you only have one or two bills that need taking care of then consolidating them probably isn’t worth your time.

The first thing I would recommend thinking about is whether consolidating your debt will save you any money at all. Most companies who offer debt consolidation services will allow their customers to combine several bills into one payment. The fees and interest rates on these debts may vary so by consolidating them you can take advantage of lower overall rates while paying off your accounts faster than if you left the debt in place.

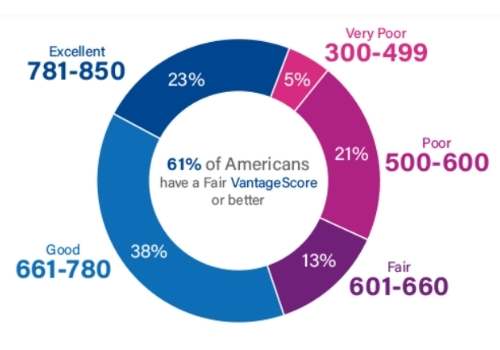

Learn more about scores on Experian

Debt consolidation is the process in which one takes out a new loan in order to pay off all of their existing debt. This is often done when people are unable to keep up with the minimum payments on their balances and collection agencies start harassing them with phone calls. In many cases, consolidating debt will involve borrowing from a bank or lending company to make a single payment each month instead of several smaller ones.

The first step in consolidating debts is finding out how much you owe and who you owe it to. Make a list of all your creditors, including credit cards, medical bills, student loans, and any other outstanding balance that needs to be paid back. Oftentimes this will include an overdraft fee from your checking account or anything you owe to a credit union.

After you’ve created your list, look at the minimum payment required by each creditor and keep track of them in a spreadsheet. This will tell you how much you’re paying in interest and what your total debt balance currently is. It will also show you which creditors are charging the highest interest rates, allowing you to target them for consolidation first.

Since your goal is to pay off all of your debts and not just one or two of them, the next step is to work out how large of a loan you can take out with all these creditors combined based on how much money you earn per month. If it’s too high to qualify for a standard bank loan, such as using a home equity loan or refinancing your mortgage, you’ll need to find alternative options. These include financing from a peer-to-peer lending group online, taking out a second job to increase your income or doing a balance transfer on a credit card that doesn’t charge an upfront fee.

Once you’ve found the company that will give you the loan and figures out how much it will cost per month, contact each of your creditors and have them send any outstanding payments to the new lender so they only receive one transaction per month from now on. After all of these payments have been received, sit down with each creditor individually and negotiate a lower interest rate so less money is being spent on finance charges over time. You can use this opportunity to have late fees waived as well as any over-the-limit charges you were assessed for going over your credit limit.

The final step is to keep up with the new payment schedule and ensure that it continues to be paid on time each month so there are no interruptions in your service. This is a great way to save money as well as get out of debt quickly, allowing you to live a healthier financial lifestyle from this point forward.

Debt consolidation can be broken into three steps: getting an idea of how much debt one owes, arranging a loan from a financial institution, and renegotiating interest rates and fees with creditors.

Types of Debt Consolidation

- Debt Consolidation Loans

- Credit Card Balance Transfer

- Debt management plan (DMP)

- Home Equity Loans and Lines of Credit

- Borrowing from retirement savings

- Student loan consolidation

Debt Consolidation Loan

This is just an unsecured personal loan that is used for paying off existing credit card debts at once so that you just concentrate on repaying the single personal loan. You will use any of the debt consolidation companies to obtain a loan for your debts so that you have one monthly payment instead of many to worry about every month. The loan is paid directly into your bank account then you make use of it to clear existing debts.

Pros of debt consolidation loans

- Gives one monthly payment instead of various payments within the same month.

- Offers lower interest rates

- You are sure of a fixed monthly payment instead of a variable monthly payment that comes with a credit card.

Debt consolidation loan rates can range from 5.99% to about 15%, depending on your credit score. This loan is offered by banks, credit unions, and peer-to-peer lenders.

Cons of debt consolidation loans

- In addition to the loan, some lenders may charge you a sign-up fee or origination fee

- Some lenders charge a prepayment penalty fee – which means you will be charged a fee when you try to pay early. It is better to avoid these types of personal loan lenders when you are going for a debt consolidation loan.

- Though the interest rate may be lower, you end up paying more in interest because of its long-term period.

List of debt consolidation loan companies that can offer personal loans

- Prosper

- Upgrade

- Lightstream

- Discover

- Payoff

- OneMain Financial

- SoFi

- Marcus by Goldman Sachs

- Monevo

- Upstart

Some of these companies can pay the creditors directly, so you don’t worry about paying them yourself.

Criteria for approval of a debt consolidation loan

Not everyone qualifies for a personal loan for consolidating debt; there are certain requirements for approval. These requirements are more strict with banks compared to other lenders.

Banks requirements for approval

Getting a personal loan for consolidating debt through the bank follows these standard procedures:

- You must have a qualifying credit score. You need an excellent or good credit score.

- You must have a good credit history.

- You must have evidence of on-time payments of previous loans (this is known from your credit history, which is gotten from credit bureaus)

- You must have a stable income and the income must be high enough to cover the monthly repayment as well as enough for you to live on. This is what is referred to as the debt to income ratio (explain what this means here). The debt to income ratio proves that you have an income that can afford the monthly repayments.

Peer-to-peer lenders requirements for approval

While banks tend to be strict, peer-to-peer lenders are a little more relaxed and do not follow the traditional standards of the banks. Bad credit borrowers can still be approved for loans but their interest rates are higher. The credit scores determine the level of interest rate; a fair credit score has a better interest rate than a bad credit score. A score of 670-739 is fair credit whereas a score below 670 is bad credit. Those with excellent credit scores have the best debt consolidation loans because they have the lowest interest rate.

The main requirements are a stable source of income and your level of education. For example, Upstart checks the level of education as well as your job history, to give an insight into your income and how stable your job is. They also check for the credit scores of their users.

When is a debt consolidation loan a good idea?

If you have good credit and an income that can support the new payment amount, then there’s no problem with consolidating debts into one easy-to-manage plan. However, taking a debt consolidation loan with bad credit is not a good idea. If your credit score has suffered due to late payments or high balances, consider refinancing your loan after you’ve repaired your credit account to include much better terms and much lower rates whenever possible.

Credit Card Balance Transfer

This method of consolidating debt involves the transfer of all credit card balances to a single credit card. It has pros and cons as well and it is not suitable for everyone. This is the most tricky of all types of debt consolidation. Ensure you read all the contracts before you sign up for them.

Balance transfer credit cards usually come with a promotional 0% annual percentage rate (APR) on balance transfers for a set period, typically between 12 and 20 months. The idea is to transfer your debts to the new card and pay off that debt during the introductory period to avoid paying interest.

When considering this method to consolidate debt, be sure your credit limit is higher than the combined credit card balances that you are transferring; this is important because, during the introductory period, you want to clear all credit cards debts to avoid paying double when the period elapses and you haven’t finished paying the balance of the previous credit card accounts. This makes things worst because some companies would now charge you deferred interest on the remaining balance.

If you don’t think you’ll be able to pay most of the balance before the promotional period ends, check to see whether your new card’s ongoing APR is lower than the rates you’re currently paying on your other cards. If it’s not, this option might not be the best way to deal with your debt.

Ensure you choose a lender that has 0% APR and 0% balance transfer (BT) fees. The reason you are seeking debt consolidation is to get rid of debt and not to add more. Some credit cards can charge as high as 10% of the transfer amount.

If you are going for the credit card balance transfer option then ensure you can pay completely all your debts during the period at which you have 0% interest because if this period elapses and you are not able to pay all the debts, you would now have to start paying double – the debt of the previous lenders and the debt of the new lender whose credit card balance you used for paying previous loans.

The interest on your new credit card is going to jump from 0% to about 15% or as high as 26% after the period of zero interest fee elapse; hence ensure you can clear the debt within that period before even signing up for a credit card balance transfer option of debt consolidation.

Pros of credit card balance transfer

- This method is good for those with high credit limits, whose combined credit balances are lower than their credit limit – this way, they can pay all the debts in the multiple credit card accounts before the introductory period of the new credit card account ends.

Cons

- The interest rate jumps after the introductory period to as high as 26%.

- Another disadvantage is that if you don’t pay the total balances transferred to the new credit card account after the introductory period of 0% APR, you could be charged deferred interest charges– which is the accrued interest of the amount of money transferred to the credit during the introductory period; the interest would be backdated and you have to pay all. So always make sure before you sign up for this method, that you can pay your total debt that was transferred to the credit card before the introductory period ends.

- Some credit card companies charge balance transfer fees (BT fees) for every transfer and this can be as high as 10% of the balance transferred. Always choose companies that have zero transfer fees

- Late payment incurs a huge increase in the interest rate of the new credit card

- You may find that the annual percentage rate (APR) for new purchases is different from the balance transfer rate; because if you make new purchases outside of the amount transferred to the card, you will be charged the standard rate for the purchase and would not enjoy the 0% APR interest initially on the card.

Debt Management Plan (DMP)

The debt management plan is another way to consolidate debt by using a nonprofit credit counseling agency. This program is only available to those having large loan amounts of unsecured debts, such as credit cards or unsecured personal loans, who are unable to make regular and timely payments. DMPs don’t cover mortgages, auto loans, or student loans.

You will need the services of a credit counselor who will review your financial situation to see if a DMP will be a good option for you. If the credit counselor sees it as a good option for you, they will now contact your creditors for negotiation of a possible lower interest rate, lower monthly payment, or lower fees; in some cases, a combination of all.

It is a form of consolidating loans because you will no more pay any of the creditors directly, the credit counseling agency now starts making the payments on your behalf; all you need to do is to send a single loan amount to the credit counseling agency every month and they would make the payments to your creditors.

Some credit counselors may require you to close your credit cards as your creditors may withdraw from the DMP program when you begin using credit cards during the period of the DMP program.

Home Equity Loans and Lines of Credit

These loans allow you to borrow up to 80 to 85% of your home equity and then you can use it to pay other high interest loans. Home equity is calculated by subtracting the mortgage balance from the market value of your home. If the remaining mortgage balance is 200,000 and the market value of your house is 250,000 USD, then your home equity is 50,000 USD. This means you can only have 85% of 50,000, which is 42,500 USD as a home equity loan.

Pros of Home equity loans

The advantage of these secured loans is the low interest rate but you risk losing your home when you default because you are using your house as collateral.

Cons of Home Equity Loan

- If you don’t pay back the loans, you could lose your home in foreclosure and may be homeless.

- There may be closing costs that you have to pay which can be 3 to 6% of the home value. These closing costs can be thousands of dollars, depending on the value of your home. For example, the closing costs of a home valued at 100,000 dollars would be 3,000 dollars when the percentage charged is 3%.

- Your home value may fall and that could put you “underwater“, a situation whereby your house value falls and you can no more have any equity on the house; this means you cannot refinance or sell the house because you have no share of the house. The fall in the value of the house has rendered your equity (share of the house) worthless.

Borrowing from your Retirement Savings account, (401)K

You could also use your 401(k) to consolidate debt. You can get 50% or a maximum loan amount of $50,000 from your retirement funds. This does not require a credit check and comes with a low-interest rate. The repayment is directly deducted from your paycheck. The amount deducted from your 401(k) can not be eligible for compound interest again.

Student Loan Consolidation

Student loan consolidation allows you to combine all your federal student loans into a single student loan debt that is easier to repay, has a lower and fixed interest rate. It is not applicable to private student loan debt.

This type of debt consolidation is a good idea if the following conditions are met:

- There is no associated cost to consolidate the loans.

- The interest rate must be fixed and should be lower than the previous loans

- The repayment period should be shorter or not more than that of the previous loans.

You can use this calculator (by Ramsey Solutions) to see how much you can save on interest if you make extra payments to your student loans.

Some people consider debt settlement as a way to consolidate debt but this does not consolidate the debts into one; it may help to reduce the amount you need to pay but would severely affect your credit score and some creditors may even sue you. You can do this yourself or you use a debt settlement company that may charge hefty fees as high as 15 to 25% of the settled loan amounts.

Pros of Debt Consolidation

- It can boost your credit score if you make timely payments; it is better than bankruptcy which hurts your credit score.

- The use of debt consolidation loans gives you fixed rates instead of variable rates of credit cards

- Helps you to repay all debts early.

- Simplifies the repayments of different credit cards by merging them into one credit card or loan and then making a single repayment.

- Consolidating credit card debt lowers your credit utilization ratio, an important factor in calculating your credit score. The credit utilization ratio shows how well you use any credit given to you. A lower credit utilization ratio shows you are good at managing your finances.

While consolidating your debts, whenever you pay your existing credit card debt, always close the account because it will help you to be debt free instead of leaving the account open where you may be enticed to take up another loan which gets you into debt again.

Cons of Debt Consolidation

- Your debts are not going to be erased, you are simply swapping lenders by combining all loans into a single loan to make it easier to pay than having multiple monthly payments of varying interest rates.

- You may end up paying a higher interest rate if your credit score is bad compared with people with good credit scores. Therefore, a lower interest rate is not guaranteed when you consolidate debt; your credit score determines it.

- May have a longer repayment term which means that the person pays more in interest even with a lower interest rate

- Some loans may require you to put up collateral such as a home equity loan.

Most times the debt consolidation loan companies offer you lower monthly payments with longer terms; that may seem nice but in reality, you are going to pay a higher amount in total interest. If you can afford to pay your debts without having to use debt consolidation, then simply do so using either of the two methods of loan repayment: the debt snowball method of paying smaller loans or the avalanche method which pays the high interest loans first.

Types of debt that you can consolidate

- Credit card debt

- Medical bills

- Student Loans

- Car Loans

- Payday loans

- Personal loans

FAQs

Is debt consolidation a good idea?

Debt consolidation is a good idea when either interest rates are high or the total amount of money owed is very high. There are definitely times when debt consolidation is a good idea and other times when it is not. Essentially, it’s a good idea to consolidate your debt if you can lower the interest rate or make it more manageable.

The decision to consolidate your debt should depend upon how much money you currently owe in total and what kind of interest rates are associated with each individual creditor. Consolidation can reduce overall monthly payments but most likely increase the length of time necessary to pay off the debt.

On the other hand, if you have a number of high-interest debts, consolidating them into one loan could end up saving you money in the long run. Ultimately, whether or not it’s a good idea has to do with your personal financial situation and what course of action will benefit you most in the long run.

Does debt consolidation affect your credit score?

Yes, debt consolidation does affect your credit score either positively or in a negative way, but it also depends on the amount of debt you are looking to consolidate.

If you have one major loan that you want to pay off along with your other smaller bills then this will essentially eliminate any monthly payments you once had which is good for your credit score because it shows lenders that you are capable of paying back larger amounts.

However, if this is not the case and instead you have multiple debts with higher interest rates under separate accounts then this may not look so great on your credit report especially if some creditors do not know about your consolidation plan.